Auto Insurance

Auto Insurance Information

Car, Auto & Truck Insurance

Ready to Get a Quote or Talk to an Expert?

What is Auto Insurance?

Auto insurance protects you against financial loss if you have an accident. It is a contract between you and the insurance company. You agree to pay the premium and the insurance company agrees to pay your losses as defined in your policy. Auto insurance provides property, liability, and medical coverage:

- Property coverage pays for damage to or theft of your car.

- Liability coverage pays for your legal responsibility to others for bodily injury or property damage.

- Medical coverage pays for the cost of treating injuries, rehabilitation and sometimes lost wages and funeral expenses.

An auto insurance policy is comprised of six different kinds of coverage. Most states require you to buy some, but not all, of these coverages. If you're financing a car, your lender may also have requirements.

Most auto policies are for six months or a year. Your insurance company should notify you by mail when it's time to renew the policy and to pay your premium.

Why Do You Need Auto Insurance?

It's really all about protecting yourself and those around you on the road.

- If you're in an accident or your car is stolen, it costs money, often a lot of money, to fix or replace it.

- If you or any passengers are injured in an accident, medical costs can be extremely expensive.

- If you or your car is responsible for damage or injury to others, you may be sued for much more than you're worth.

- Not only is having insurance a prudent financial decision, many states require you to have at least some coverage.

What are Limits and How Much Coverage Do I Need?

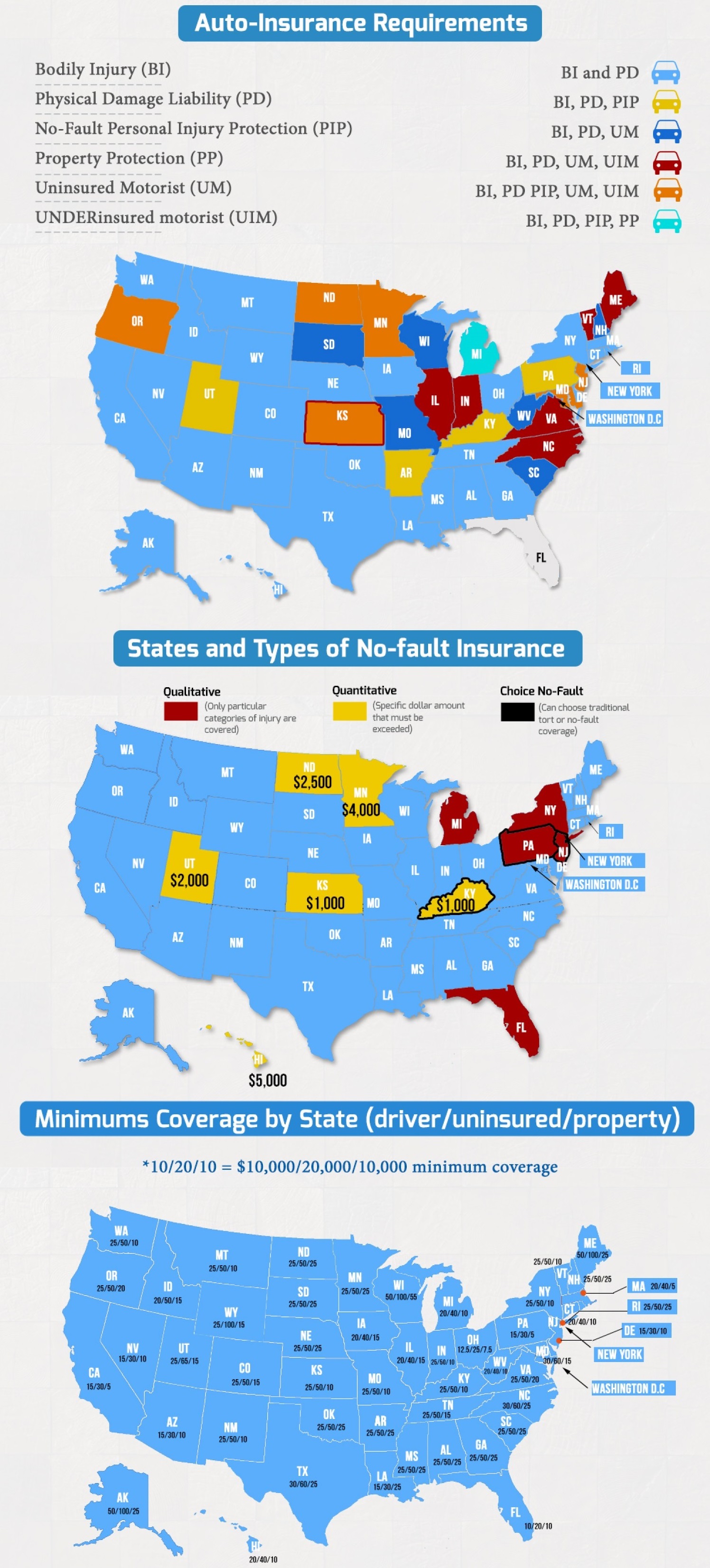

Most states have their own coverage minimums for the insurance policy coverages that are needed by drivers. If you're wondering if you need collision insurance check out another post here: What is Collision Insurance and Do I Need It?

Here's an infographic that can also help:

Questions to Ask Your Agent:

Your Independent Agent is an advocate for finding auto insurance that meets your specific needs. Here are a few things to consider as you prepare for the discussion:

- How much can you afford to pay if you get in an accident? (To keep premiums low you may want to have a higher deductible and be willing to pay more for repairs.)

- What is the insurance company's level of service and ability to pay claims?

- What discounts are available? (Ask about good driver, multiple policies, and student discounts.)

- What's the procedure for filing and settling a claim? (Ask who to call and what happens after you file a claim.)

Additional Resources:

Car and Auto Blog Posts Here

Contact Us via the Web

To contact Alliance Insurance Group via the web, please fill out the following form as completely as possible. When finished, click the Submit button to send your contact request. You will receive a response from us shortly.

|